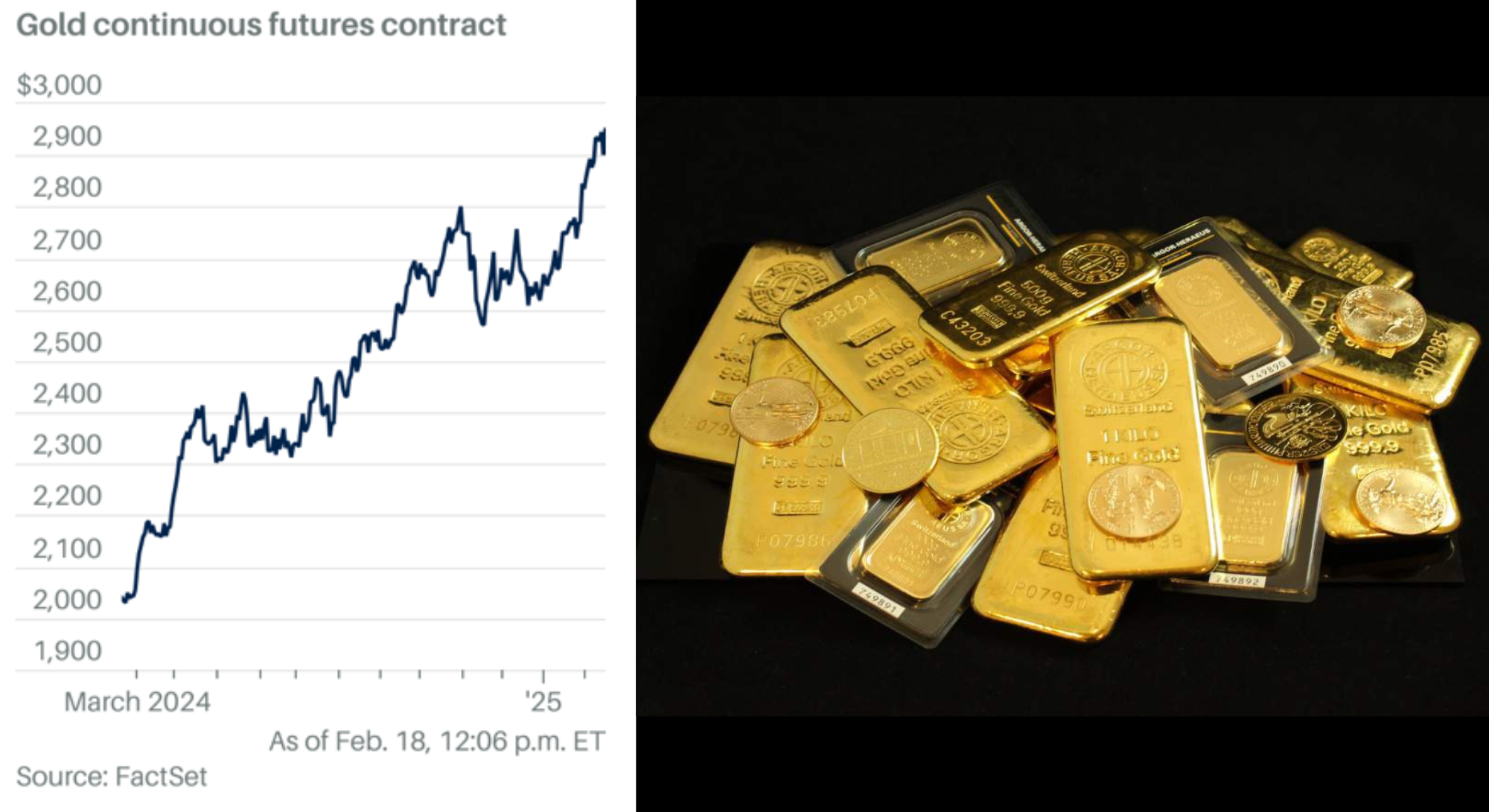

Goldman Sachs: gold to beat Bitcoin long term

Anna Golubova @ Kitco

Gold is a more "useful portfolio diversifier," and it is expected to outperform Bitcoin in the long term, according to Goldman Sachs.

The precious metal, with its real demand drivers, is not impacted by tighter financial conditions as much as the world's largest cryptocurrency, Goldman said in a note Monday.

Gold is "a useful portfolio diversifier," said Goldman, noting that the precious metal has clear non-speculative use cases while Bitcoin is still searching for one.

Traders treat Bitcoin as a "risk-on high-growth tech company stock," while gold is used as a hedge against dollar devaluation and inflation.

Bitcoin is still "a solution looking for a problem," and its potential comes from future use cases. And this makes it a much more volatile and speculative asset class than gold, Goldman explained.

Bitcoin adoption surged when investors became interested in decentralized currencies, but tighter financial conditions will not work in the cryptocurrency's favor.

"Bitcoin's volatility to the downside was also enhanced by systemic concerns as several large players filed for bankruptcy," including the FTX crypto exchange and the Three Arrows Capital (3AC) hedge fund.

Year-over-year, spot gold is up 0.23%, while Bitcoin is down 63%. At the time of writing, spot gold was at $1,792.60 an ounce, and Bitcoin was at $17,171.

Looking forward, gold will get a boost from additional macro volatility. "Gold may benefit from structurally higher macro volatility and a need to diversify equity exposure," the note added.

Also, "tighter liquidity should be a smaller drag on gold, which is more exposed to real demand drivers," Goldman wrote. Those include physical demand, central bank buying (which has been at a record pace this year), safe-haven investments, and industrial applications.