Seeking Alpha: 3 Factors Behind Gold's Recent Rally

Summary

- Gold prices have surged, nearly doubling since late 2022.

- The world's central banks have been steadily increasing their gold reserves, viewing gold as a currency rather than a commodity.

- U.S. consumers and businesses are worried about the prospect of higher inflation.

By Erik Norland

At a Glance

Gold prices have surged, nearly doubling since late 2022

The world's central banks have been steadily increasing their gold reserves, viewing gold as a currency rather than a commodity

Gold prices have been rising, recently rallying to record highs. What's behind this rally, and how long could it continue? There are the three primary factors driving the yellow metal.

1. Expectations of Fed Rate Cuts

As of early April, Fed Funds futures priced in a significant probability of further rate cuts by the Federal Reserve later in 2025. Lower interest rates typically make holding fiat currencies, such as the U.S. dollar, less attractive relative to hard assets like gold. If the Fed follows through with these cuts or more than expected, this could fuel gold’s rally. Conversely, if the Fed stays on hold or hikes rates instead, this could potentially derail gold’s upward trend.

2. Inflation Expectations

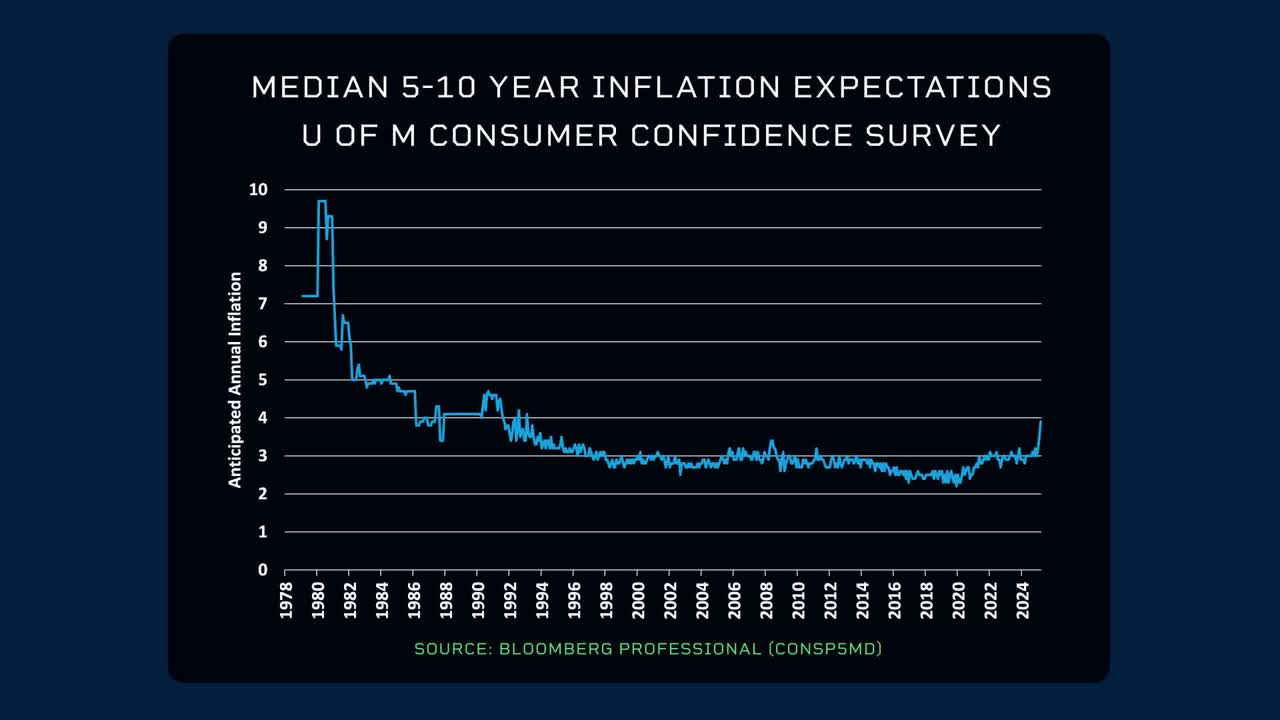

U.S. consumers and businesses are worried about the prospect of higher inflation. The University of Michigan's consumer confidence survey revealed that inflation expectations over the next five to 10 years hit a 33-year high in March.

Additionally, the "prices paid" components of the ISM Manufacturing and Services business surveys indicate that American companies are facing increasing cost pressures. Higher cost pressures combined with the potential for lower central bank rates, could further fuel inflation expectations. When higher inflation is anticipated, investors often turn to real assets like gold for protection.

3. Central Bank Buying

Since 2008, the world's central banks have been increasing their holdings of gold. This trend suggests that central banks view gold as a currency rather than a commodity, and that they prefer holding gold over fiat currencies like the dollar or euro amid rising geopolitical and trade uncertainty.

.png?width=1500&height=626&name=Copy%20of%20GIF%20HEADER%201%20(1).png)