- Investors sent the Dow to a record high on Wednesday after the Fed signaled rate cuts are coming.

- But the Fed's new growth forecast points to overvalued stocks and a recession, David Rosenberg said.

- The veteran economist has been warning for years that stocks will crash and a recession will hit.

Investors sent the Dow to a record high on Wednesday after the Federal Reserve signaled the inflation threat is fading, and it expects to cut interest rates three times in 2024. They may be celebrating too soon, David Rosenberg has warned.

Fed Chair Jerome Powell struck a positive tone after the central bank's latest meeting. He pointed to the pace of price growth slowing markedly in recent months, unemployment hovering at historic lows, and economic output proving resilient.

Yet Rosenberg, a veteran economist and the president of Rosenberg Research, noted in a pair of X posts on Wednesday that the Fed's latest growth projection suggests stocks are overpriced and a recession is virtually guaranteed.

A company's stock is typically valued at a multiple to its earnings per share, which tend to be correlated to GDP, as businesses produce goods and services that contribute to a country's output, and typically generate more sales and profits when the economy is growing.

"There is no recession risk at all embedded in equity valuations," Rosenberg said in a research note on Thursday, emphasizing that he believes stock investors are too optimistic about what's ahead.

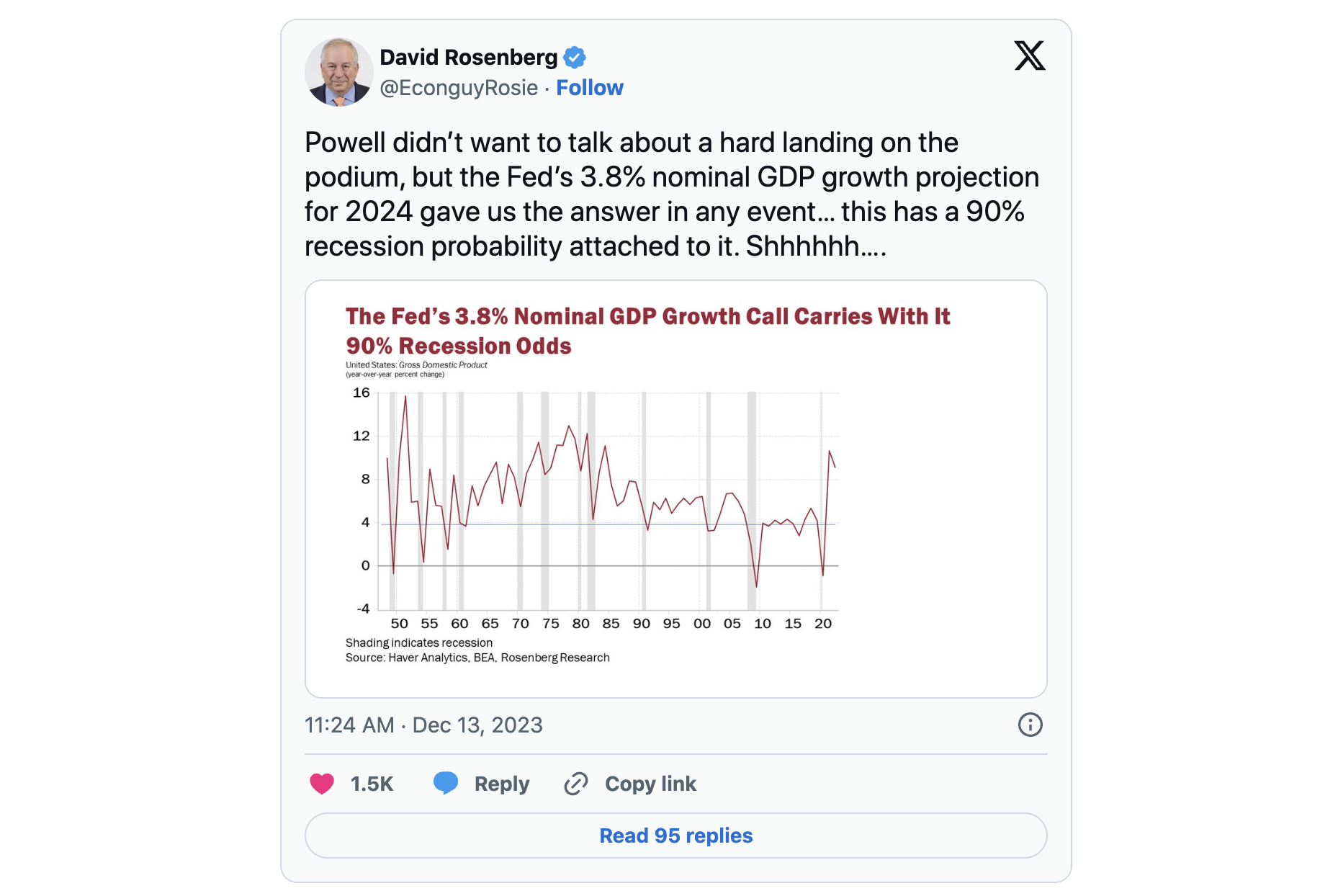

Rosenberg also cautioned on X that the Fed's forecast of slower GDP growth next year implies a 90% probability of recession. He explained that his team expects inflation to plummet below 1% next year, making 3.8% nominal growth "very difficult to achieve," and closer to 2% more realistic.

"From my lens, given what the monetary policy lags imply and the withdrawal of fiscal stimulus means for real GDP growth for 2024, we are likely talking about real growth of no better than +1.0% and quite possibly zero," he said in a note to clients.

"That is rare but not unprecedented: we saw this in 1949, 1954, 1958, 2008, and 2009 — all recessions," he said. "Maybe the odds are 100% instead of 90%."

"What was delayed in 2023 shall not be derailed in 2024," he added.

Rosenberg has been sounding the alarm on a stock-market crash and recession for years, going as far as comparing the current situation to the dot-com and housing bubbles. However, stocks have surged this year and the economy has proven surprisingly resilient, defying his dire predictions.