KITCO: America is going Bankrupt

Elon Musk says ‘America is going bankrupt’ as 76% of June tax receipts went to interest on debt

The fiscal position of the United States continues to deteriorate as the federal government’s deficit has swollen to $1.27 trillion in the fiscal year ending in June, hampered by surging interest payments on the growing national debt, which is quickly approaching $35 trillion.

The situation is exemplified by the data from June, with the Treasury Department reporting record-high receipts of $466 billion – which would be impressive if not for the fact that the government still ran a deficit of $66 billion for the month, as reported by Bloomberg.

While the data showed a slight improvement year-over-year – with the June 2024 shortfall coming in $5 billion less than the one from June 2023 – there is still a long way to go to get to even. Meanwhile, the Federal Reserve’s insistence on keeping interest rates higher until the economy moves meaningfully towards its 2% inflation target only complicates the matter.

Interest rates remain at their highest levels in over a decade, with the weighted average interest rate on U.S. total marketable government debt registering at 3.3% at the end of June. As a result, the interest on public debt hit $140 billion for the month, bringing the running total for the first nine months of the current fiscal year to $868 billion, 33% higher than the same period last year.

This represents the largest deficit since 2008 and is approximately 60 basis points higher than a year before.

While tax receipts remained strong compared to 2023, Treasury officials acknowledged that much of the year-over-year gains could be attributed to a deferral of tax deadlines from fiscal 2023 into this year in states that suffered from natural disasters, including most areas of California.

Further highlighting the difficult situation that the economy faces is the fact that the Federal Reserve saw a net negative income of $114.3 billion in 2023, according to Reuters – a record loss brought about by the central bank’s efforts to manage its short-term interest rate target.

The record loss came after the Fed enjoyed a $58.8 billion net income in 2022, a number that is somewhat misleading as the central bank also sat on more than $1 trillion in unrealized losses from holding underwater securities.

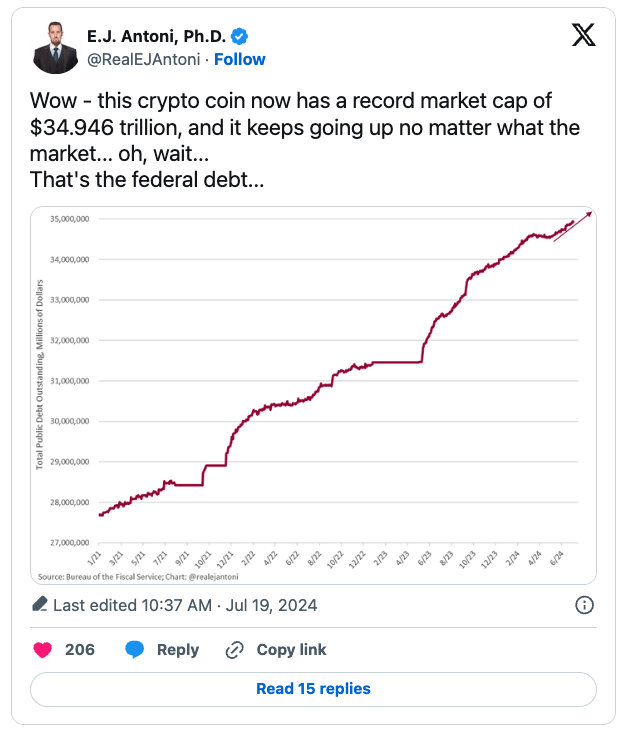

According to Economist E.J. Antoni, the June numbers from the Fed indicate that “Interest on the federal debt was equal to 76% of all personal income taxes collected in June – that's the Treasury's largest source of revenue and three-quarters of it gets consumed just by interest.”

A follow-up post from Antoni noted, “Just the cost to service the federal debt (pay the interest) has exploded 33.0% in a single year, and it's getting worse,” suggesting that debt printing has gone ‘hockey-stick’ exponential.

“Treasury now expects interest on the federal debt to breach $1.14 trillion this fiscal year; if that estimate is anything like their usual overly optimistic projections, then be prepared for it to be much higher,” he said. “Interest on the debt surpassed both the Dept. of Health and Human Services and the Social Security Admin. to become the single biggest line item in the Treasury's monthly statement for Jun - still think this is fine?”

“Interest is now equal to more than three-quarters of all personal income taxes, and over 30% of all taxes and duties received by the Treasury in June,” Antoni wrote in an article. “Not only is the nation drowning in debt, but now the interest payments are an anchor around its neck.”

“For the federal government, creating money is the preferred way to conduct a backdoor default on its obligations,” he said. “Through the Federal Reserve, the government has been expanding the money supply and devaluing the dollar, including the nearly $35 trillion that make up the federal debt. This allows the government to repay that debt, and pay the interest, using depreciated currency.”

“If you loaned the government $1 at the start of 2021 and got it back today, it’d only be worth about 80 cents,” he noted. “Even if you received 5% interest each year, you’d still be getting less back from the Treasury than you originally lent out.”

“This is why the stratospheric rise in the interest on the debt should concern everyone. Not only is it displacing funding for things like roads and the military, but it will also mean much more inflation unless we take a chainsaw to federal spending, à la Argentinian President Javier Milei,” Antoni concluded. “That course correction had better come quick. The federal government is already running $2 trillion annual deficits, driving up interest on the debt exponentially. The time bomb of federal finance has already started ticking down.”

Responding to a different article covering Antoni’s insights, X owner Elon Musk, the world’s richest man, tweeted, “America is going bankrupt btw.” He followed up that response with the post below, asking, “Where are we with dollar value destruction, you might ask?”

In response to Musk’s posts, veteran trader Peter Brandt said the “U.S. Dollar is being destroyed.”

“All paper currencies are being destroyed. An entirely new system of payments and store of value will evolve during next decade,” he added. “Do you want Kamala Harris in charge of this because revolution in currencies units will happen.”

%20(2).png?width=850&height=500&name=Untitled%20(850%20x%20651%20px)%20(2).png)