JPMorgan boosts its 2024 projections for Fed rate cuts, gold investment

Gold prices are continuing to hold above $2,000 per ounce in the new year, and the precious metal will benefit from additional rate cuts in 2024, along with the return of investment demand, according to commodities analysts at JPMorgan.

While the investment bank still maintains that “the only structural bullish call we hold is for gold and silver,” precious metals are expected to lose some of the additional boost provided by high inflation.

“Commodities are unlikely to benefit from core inflation in 2024,” said Natasha Kaneva, Head of Global Commodities Strategy at JPMorgan. “Inflation should fall to under 3%, so that, along with properly timing the business cycle, are the two conditions needed to initiate long positions, making the outlook for the sector very tactical in 2024.”

Economic and geopolitical uncertainty tend to be positive drivers for gold, which is widely seen as a safe-haven asset due to its ability to remain a reliable store of value. It has low correlation with other asset classes, so can act as insurance during falling markets and times of geopolitical stress. A weaker U.S. dollar and lower U.S. interest rates also increase the appeal of non-yielding bullion.

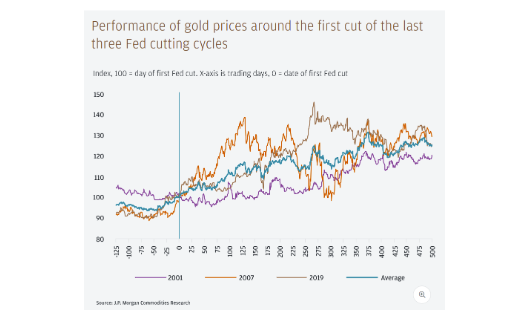

The analysts pointed out that anticipation of a Fed pivot has played a key role gold’s recent price rally, as it has over the last three rate cutting cycles.

“At the moment, gold still appears quite rich relative to underlying rates and foreign exchange (FX) fundamentals, and still looks vulnerable to another modest retreat in the near-term, as Fed rate cut expectations are now running earlier than our forecasts,” he said.

Shearer added that any price pullbacks in the coming months should be treated as buying opportunities ahead of a breakout rally which they expect to begin in mid-2024 as U.S. GDP growth slows.

JPMorgan Research now predicts the Fed will deliver 125 basis points of cuts over the second half of 2024, which is 25 bps more than they projected in their 2024 outlook published just last month, as the central bank works to head off a U.S. recession.

“Gold price predictions are based on Fed official forecasts, which see core inflation moderating to 2.4% in 2024 and 2.2% in 2025, before returning to the 2% target in 2026,” the analysts wrote.

Based on this updated economic outlook, JPMorgan forecasts the U.S. 10-year nominal yield will fall 30 bp from 3.95% at the end of Q1 to 3.65% by the end of 2024, with the real yield declining from 1.75% to 1.45% over the same time frame.

“We think over this period, the Fed cutting cycle and falling U.S. real yields will once again become the mono-driver behind gold’s breakout rally later in 2024,” Shearer said. “Gold’s inverse relationship to real yields has historically been weaker over Fed hiking cycles, before strengthening again as yields fall over a transition into a cutting cycle.”

Falling yields will drive gold prices to new nominal highs in H2 2024, averaging $2,175 per ounce in Q4, and they expect a quarterly average peak of $2,300 per ounce by Q3 2025.

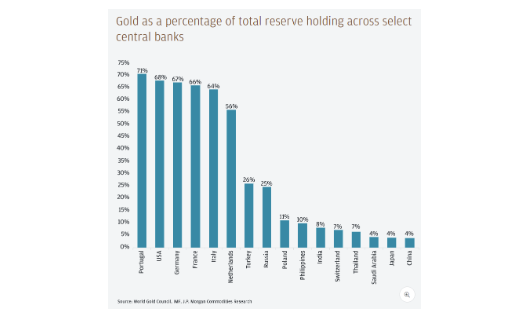

The analysts predict central bank buying will continue to support gold prices through 2024, while positive net ETF flows will finally return later in the year.

“There is still scope for boosted reserves at some central banks as institutions look to diversify reserve assets, so purchasing is likely to remain structurally elevated compared with the late 2010s,” Shearer wrote.

“As of the end of 2023, managed money in net long positions — where more investors expect the price of gold to rise rather than fall — only screened at around 6/10 on a standardized scale, with 10 being the net longest positioning since 2018,” they said. “This means there is still a lot of capacity for investors, through the purchase of gold either on an exchange or via an exchange-traded fund (ETF), to increase their long positions.”

“As rates eventually come down, we would expect recent ETF outflows to reverse with a return to retail-led ETF inflows boosting gold investor demand too, strengthening a move higher in prices,” Shearer said. “Continued robust central bank purchases, along with boosted physical demand on price dips will likely remain a significant support to prices over the final twists and turns of the Fed cycle.”

.png?width=500&height=500&name=D%20(1).png)