Gold predicted to climb higher than expected as records shatter

Gold is forecast to climb higher than previously expected as central banks in emerging markets have ramped up purchases, according to Goldman Sachs Research.

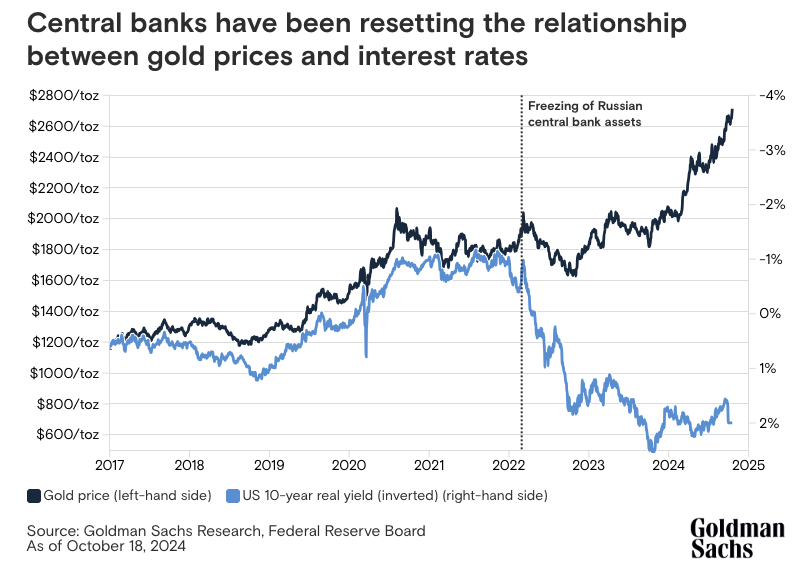

Gold usually trades closely in line with interest rates. As an asset that doesn’t offer any yield, it typically becomes less attractive to investors when interest rates are higher, and it’s usually more desirable when rates fall. While that relationship still holds, central bank purchases have been a powerful force, resetting the level of gold prices higher since 2022, Goldman Sachs Research analyst Lina Thomas writes in her team’s report.

What is the prediction for gold prices for 2025?

The precious metal is predicted to rise to $3,000 per troy ounce by end-2025, Thomas writes. Gold has risen to multiple all-time highs this year.

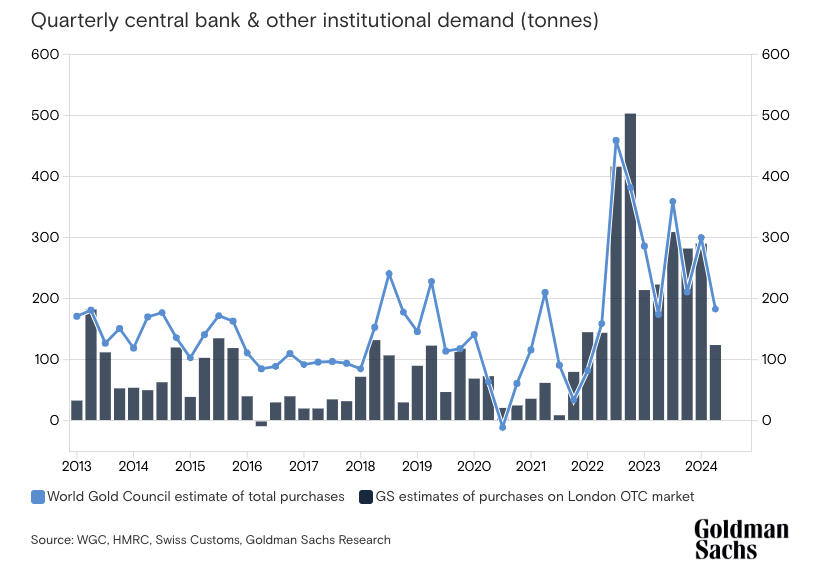

Thomas points out that the relationship between changes in the gold prices and changes in interest rates still exists, but sizable central bank purchases of gold bars have reset the relationship between rate and price levels since 2022. Goldman Sachs Research estimates that 100 tonnes of physical demand lifts gold prices by at least 2.4%.

Why has the price of gold increased?

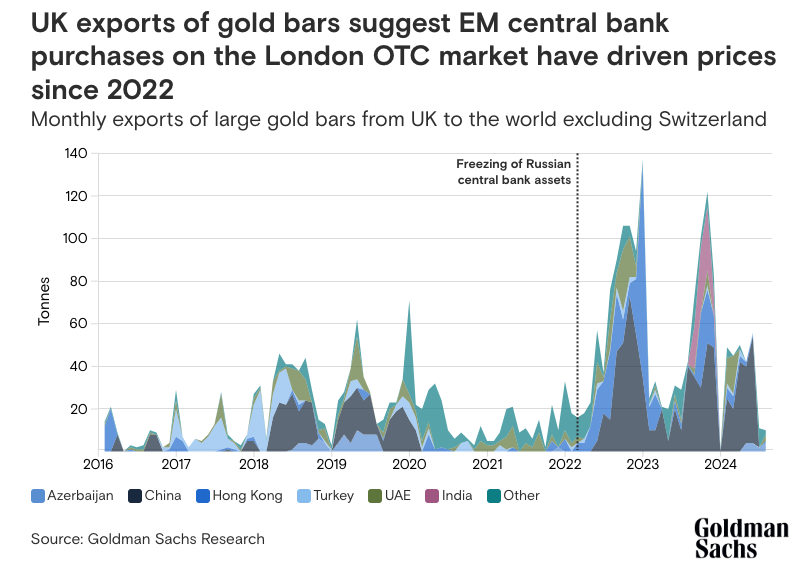

Concern about the risk of financial sanctions is likely one of the reasons central banks have increased their buying of gold. Emerging market central bank purchases of gold have risen notably since the freezing of Russian central bank assets in 2022, following Russia’s invasion of Ukraine, according to Goldman Sachs Research.

Thomas also points out that central banks in developed markets have tended to have relatively high holdings of gold as a share of reserves. For instance, the US, France, Germany, and Italy have gold holdings that make up 70% of their reserves. Their emerging market counterparts, by contrast, have smaller shares. China, for example, reports to have 5% of its reserves in the metal. Seen that way, some central banks in emerging markets are catching up to their counterparts in developed countries.

Policymakers also appear concerned about the debt sustainability of the US, which has about $35 trillion of borrowing, amounting to 124% of GDP. Many central banks have the bulk of their reserves in US Treasury bonds, and policymakers may be increasingly concerned about their exposure to fiscal risks in the US.

With the US presidential election in focus, Western investors are returning to the gold market, according to Goldman Sachs Research. Gold may offer hedging benefits against potential geopolitical shocks, including potential rises in trade tensions, Federal Reserve subordination risk, and debt fears.

ETF holdings of gold may climb

Many Western investors have been nervous about chasing gold prices higher, Thomas says. Some think they’ve missed the rally and are wary of buying gold at all-time highs. Some are also struggling to make sense of gold prices, which in 2022 began to diverge from their traditional relationship with interest rates.

That said, Goldman Sachs Research expects gold holdings in Western exchange-traded funds to gradually increase as interest rates fall, which would be in line with their historical relationship. Even as central bank buying of gold may be moderating, there could be some competition for gold bullion between central banks and Western investors as gold ETF holdings begin to climb.

“Long-term investors are now interested in holding gold because rates are lower,” Thomas says. “At the same time, central banks holdings are probably still going to pile up.”