Gold Gallups up the US long-term investment charts

Louise Street, Senior Markets Analyst @World Gold Council

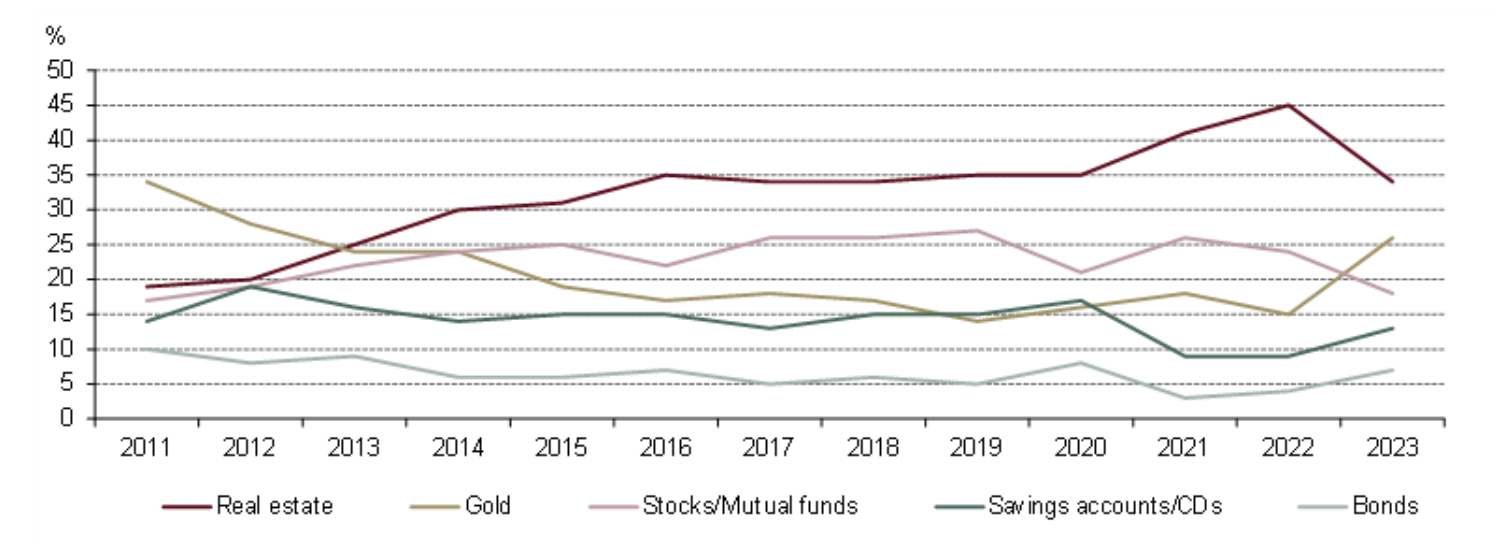

The latest Gallup Poll Social Series monitoring public opinion on economy and finance shows that gold jumped into second place as ‘best long-term investment’ in the US this year. 1

And here’s the kicker: while higher rates seem to have dampened investors’ perception of real estate as the best long-term investment (its share of the vote plunged from 45% to 34%), they haven’t damaged perceptions of gold. On the contrary, the number of Americans naming gold as the best long-term investment almost doubled this year from last. This, despite interest rates climbing to a 16-year high in March.

Over one quarter of US adults plumped for gold as their top choice in Gallup’s April poll, the highest for 11 years. This nicely echoes our data on US bar and coin investment: in our latest issue of Gold Demand Trends we reported that US investors bought 36 tonnes of gold bars and coins in Q1 this year, up sharply on the previous quarter.

One quarter of Americans view gold as the best long-term investment*

Source: Gallup

* Q: Which of the following do you think is the best long-term investment? Base: 1,013 US adults. Survey ran April 3-25 2023.

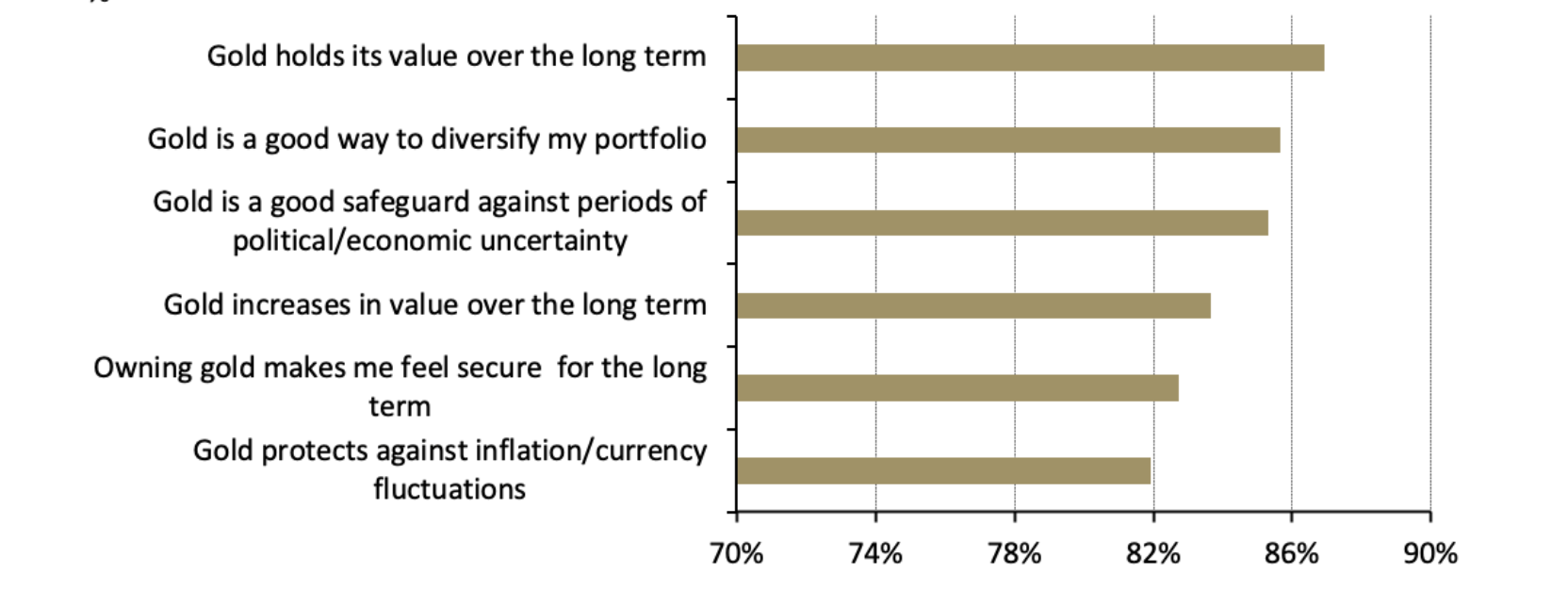

Our own research has shown a keen recognition of gold’s long-term value proposition and safe haven attributes in the US, with around two thirds of investors agreeing that ‘gold is a good safeguard against periods of political and economic uncertainty’ and that ‘the price of gold increases over time’. 2 Unsurprisingly, this conviction increases among those who have invested in gold: 87% of gold investors in the US agree that it holds its value over the long term. 3

Gold investors are keenly aware of its wealth protection and safe-haven potential

Source: Appinio, World Gold Council

Source: Appinio, World Gold Council

* Q: Please indicate how much you agree or disagree with the following statements for why you invest in gold. Base: 1,095 gold investors.

Gold’s recent performance may have helped to bump it up the rankings. It’s interesting to note that the respondents who already own stocks have the lowest conviction in stocks than they’ve had since 2012: only 25% of stock owners view stocks at the best long-term investment. The same number (24%) think gold is better up to the task. This could be due to the relative performance of each over the past 12-18 months, with gold outshining the gloomy performance of US stocks.

And as US consumers raise their longer-term inflation expectations, gold’s historical performance as an inflation hedge may also be at play. According to the Gallup poll, conviction in savings accounts/cash deposits as a good long-term investment increased only slightly this year, even with cash deposit rates reaching 5%. But these rates are still quite poor in real terms and anyone expecting persistent inflation may be tempted more by the long-term investment proposition of gold than that of savings accounts. Our research shows that gold’s potential to ‘protect against inflation/currency fluctuations’ is well recognised among gold investors.

All in all, the survey results point towards Americans being familiar with gold’s potential for long-term wealth protection. Which is particularly valuable at a time when there are few – if any – dependable safe-havens also offering the potential for long-term returns.