Platinum: It doesn’t have to run out to become unavailable

Whenever there is an argument about the sufficiency of resources to meet the demands of our voracious industrial economy, those defending the cornucopian view say, “But, we are not running out of that resource.” Of course, that is not the point. It is more likely that the first phase of resource depletion will be that not everyone who was previously able to afford a particular resource will continue to have access to it at affordable prices.

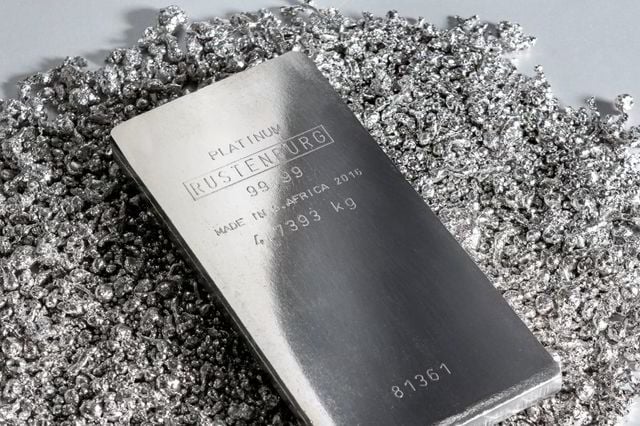

Enter platinum, which may soon be in short supply since the country that produces 75 percent of it, South Africa, is running low on power to mine and refine it. There are two things to notice here: First, the geographic concentration of the source of supply, and second, that energy is the critical resource without which all the other resources we take for granted would become unavailable to us.

Why should we care? Platinum is a precious metal, but mostly it is an industrial metal used as a catalyst in catalytic converters for motor vehicles (to reduce noxious tailpipe emissions), in the production of hydrogenated of vegetable oils (not good for the health, but it keeps them from spoiling too quickly), and in the refining of petroleum to obtain high octane elements. Platinum is also found in electrodes, in human body implants because of its high degree of compatibility with human tissue, and, of course, in jewelry and high-end watches.

We might be able to live with less platinum, but there would be major adjustments in the industries affected. Moreover, this assumes that those resources which might make up for the loss of platinum, for example, palladium, will be readily available. But if everyone who currently uses platinum starts hoarding palladium, the price and availability of that resource will become questionable.

Of course, the cornucopian’s answer is that high prices will bring on more production. Yes, that’s true, but wait, a vast amount of the world’s palladium comes from guess where: South Africa. Perhaps after many years of looking we’ll find supplies elsewhere. Perhaps.

But much of the palladium produced each year is a byproduct of nickel mining. So, unless the price of nickel is also suitably elevated, it will be hard to get the mining companies to look for nickel, just to recover the palladium. (This is true for a number of metals including gallium, a critical metal for semiconductors and photovoltaic cells, which is a byproduct of aluminum and zinc ores.)

By the way, the other big supplier of palladium is Russia.

As the geopolitical and energy complications we face grow in the coming years, we may find that platinum is just one of many critical resources that we won’t have enough of at affordable prices. The cornucopian view of resources depends not only on a belief in easily accessed and abundant resources (which are being consumed at ever higher rates) but also a cooperative and tranquil geopolitical backdrop. Of course, resource shortages can also be a reason for military conflict that would further destabilize our global diplomatic and trade arrangements creating a feedback loop that causes further shortages.

Turns out that is already happening. The conflict in Ukraine is exhibit number one. And, tensions between China and the United States have already led to trade restrictions on critical products such as semiconductors. Still, many people expect us to get back to normal sometime soon. I don’t think those people are paying close enough attention to what is actually happening.