Bank of America identifies the next bubble and says investors should SELL STOCKS rather than buy them after the last rate hike

By Barani Krishnan @ investing.com

Another bubble has emerged, courtesy of the bank-sector crisis which has already felled three U.S. regional banks.

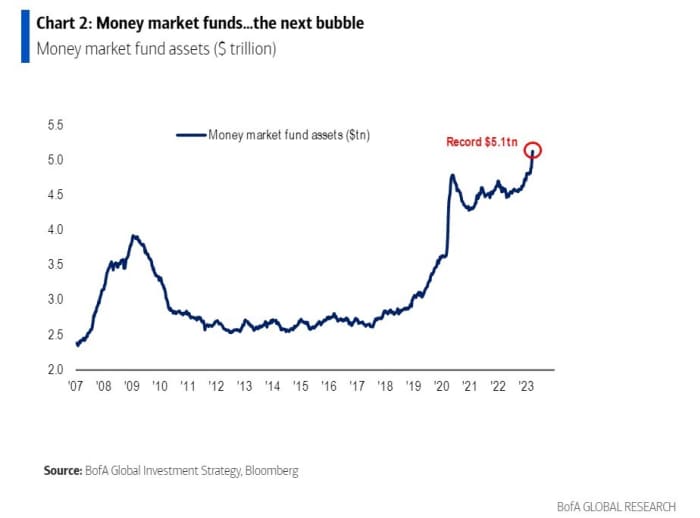

Bank of America analysts led by the Michael Hartnett say money-market funds are the new hot asset.

They point out that assets under management for money funds has now exceeded $5.1 trillion, up over $300 billion over the past four weeks. They also counted the biggest weekly flows to cash since March 2020, the biggest six-week inflow to Treasurys ever, and the largest weekly outflow from investment-grade bonds since Oct. 2022.

The last two times money-market fund assets surged — in 2008 and in 2020 — the Federal Reserve slashed interest rates. Hartnett is fond of the saying, “markets stop panicking when central banks start panicking,” and he noted a surge in emergency Fed discount window borrowing has historically occurred around a big stock-market low.

There is one difference this time, in that inflation is a reality and that labor markets, not just in the U.S. but in other industrialized nations, remains exceptionally strong. The Bank of America team counted 46 interest rate hikes this year, including by the Swiss National Bank after its rescue of Credit Suisse last week.

History, according to the BofA team, says to sell the last interest rate hike. “Credit and stock markets are too greedy for rate cuts, not fearful enough of recession,” they say. After all, when banks borrow from the Fed in an emergency, they tighten lending standards, which in turn results in less lending, and that leads to less small-business optimism, which eventually cracks the labor market.

Bond yields TMUBMUSD10Y, 3.356% and U.S. stock futures ES00, -0.47% dropped on Friday, as shares of Deutsche Bank tumbled in Frankfurt.

The S&P 500 SPX, -0.51% has gained just under 1% this week.